A 10 minute introductory tour of using Spire, managing daily tasks and following the life of a sales order.

Spire version 3.11 has been released with greater flexibility and functionality when managing price levels and future pricing changes, maintaining and entering user defined fields, and configuring sales tax exemptions on inventory items.

When you stock your inventory in multiple places, you can configure warehouses for address information and maintain separate quantities on hand. Transactions have items allocated to a specific warehouse for quantity and amount handling

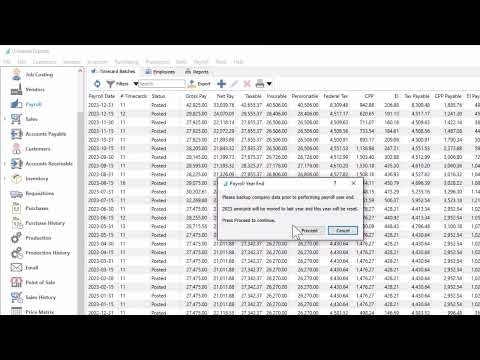

Before you are able to process payroll timecards in a new calendar year, you must first close the previous year to lock in employee pay statistics for reporting and CRA forms. Then you can enter TD1 form amounts and be ready for the next payroll.

When some of the inventory items you sell to customers is not charged all taxes in your jurisdiction, you can specify sales tax exceptions. Configure them either directly on the inventory item or related product code record.

A three minute video highlighting some key information stored on sales order work flow and generating customer documents.

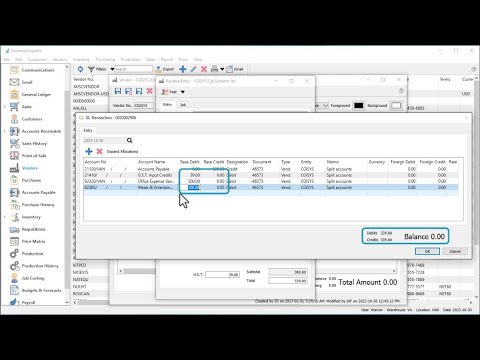

When you need to create a vendor invoice with multiple expense accounts, that don’t neatly fit allocation account usage, you can access the Ledger transaction list prior to posting. This also allows adding additional lines for other accounts or segments.

A two minute video highlighting some key information stored on ledger account records.

A two minute video showing how to open record and transaction windows to display related information from another data entry location

A 5 minute video demonstrating where to find Spire modules and common features.